This suggests its strong influence and presence within its sector.Īlthough the stock’s short-term returns have been somewhat mixed, the company’s overall financial strength, substantial market presence, and history of delivering positive returns could make RIL an appealing addition to an investment portfolio. Dividend announcements can attract income-oriented investors.ĭiversified Sectoral MCap Rank: RIL holds the top position in terms of sectoral market capitalization rank. The stock has provided a positive return of 21.51% over the past 3 years and an impressive return of 113.89% over the past 5 years.ĭividend Yield and Dividend Announcement: While the dividend yield of 0.31% might not be exceptionally high, it’s notable that the company has announced a dividend of Rs 9.0 per share.

Over both the short and long term, RIL has shown strong historical returns.

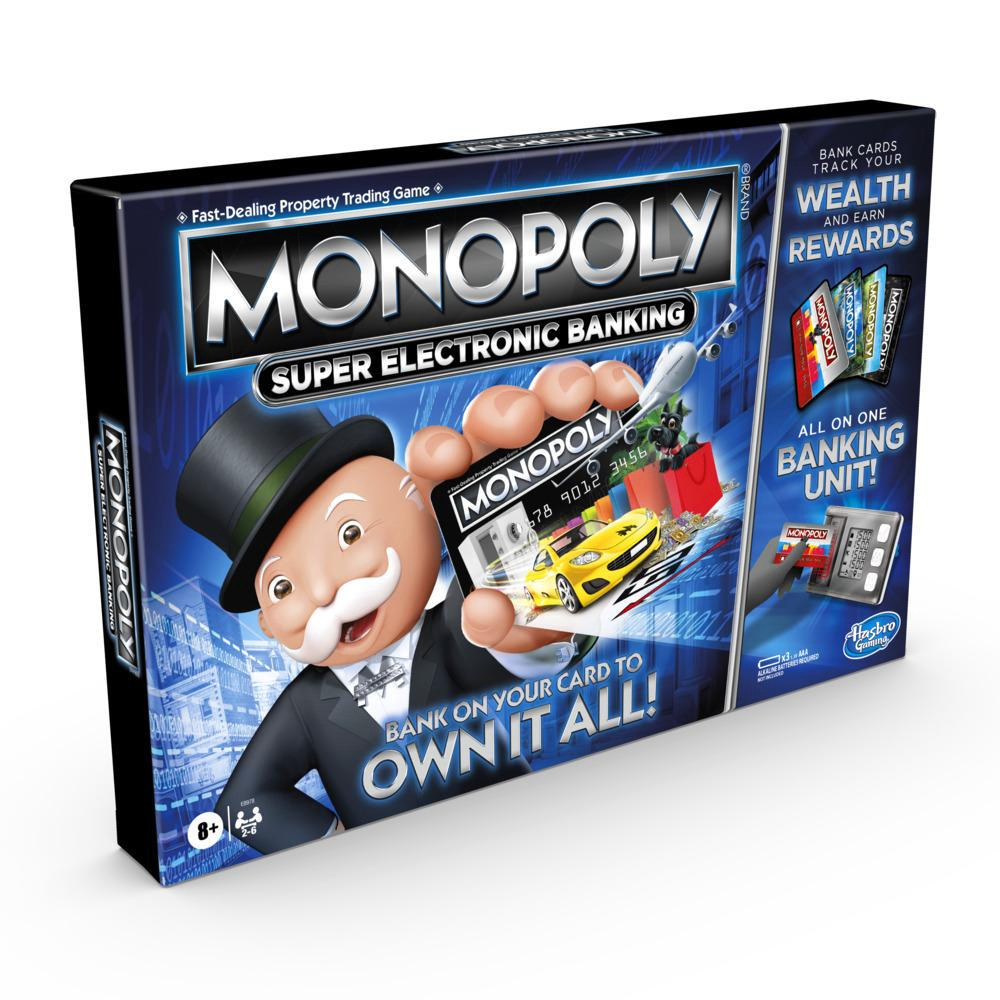

This could indicate that investors are getting a good value relative to the company’s net assets. The PB ratio of 1.87 implies that the stock is trading at a reasonable multiple of its book value. RIL has a significant market capitalization of INR 17,43,795 Crores, highlighting its substantial presence in the market and potential stability. A higher EPS indicates a company’s ability to generate considerable earnings, which is a favorable sign for investors. With a TTM EPS of INR 77.32, RIL showcases robust profitability on a per-share basis. This suggests that the stock might not be excessively overvalued, making it potentially attractive for investors seeking a balanced valuation. The PE ratio of 26.84 indicates that the stock is trading at a reasonable multiple of its earnings. Incorporating these insights, investors could be drawn to IRCTC’s solid fundamentals, impressive historical returns, and the company’s commitment to generating strong earnings and shareholder value. While the short-term returns have experienced fluctuations, the positive momentum in returns over the past 3 months and 3 years points to a potential upward trajectory in stock value. Additionally, the fact that the company outperformed its 5-year average ROE is a positive sign, suggesting continuous improvement in profitability. This not only demonstrates the company’s financial strength but also its potential for sustainable growth.įurthermore, IRCTC’s history of delivering a remarkable 3-year return of 134.51% indicates its capacity for capital appreciation over the medium term. I tried this and was advised by a crew member that you only get stickers with fruit and veg bags if you have them as part of a meal – in place of your fries.IRCTC’s strong EPS of INR 12.41, coupled with its consistently high Return on Equity (ROE) of 40.58% for the year ending March 31, 2023, reflects the company’s ability to generate robust earnings and effectively utilize shareholder capital. If you were planning to add on a fruit bag, veg bag or side salad to get yourself some bonus stickers, then, unfortunately, this won’t work. (Prices are correct as of September 2023) Menu Item The following table shows the price of items on the McDonalds menu as well as how many Monopoly stickers they come with: Medium and large drinks have the same number of stickers However, you can get a fizzy drink or McCafe Iced drink with game pieces at any time of the day. McDonalds Monopoly stickers aren’t available on breakfast menu items – you can only get them with food after 11 am. Do you get Monopoly stickers on breakfast? But don’t forget, you get two extra peels in the Digital Peel game in the app. But in 2023, every qualifying menu item has two stickers. In previous years, some items had two stickers and some had three stickers. Vegetable Bag (only if ordered as part of a meal)

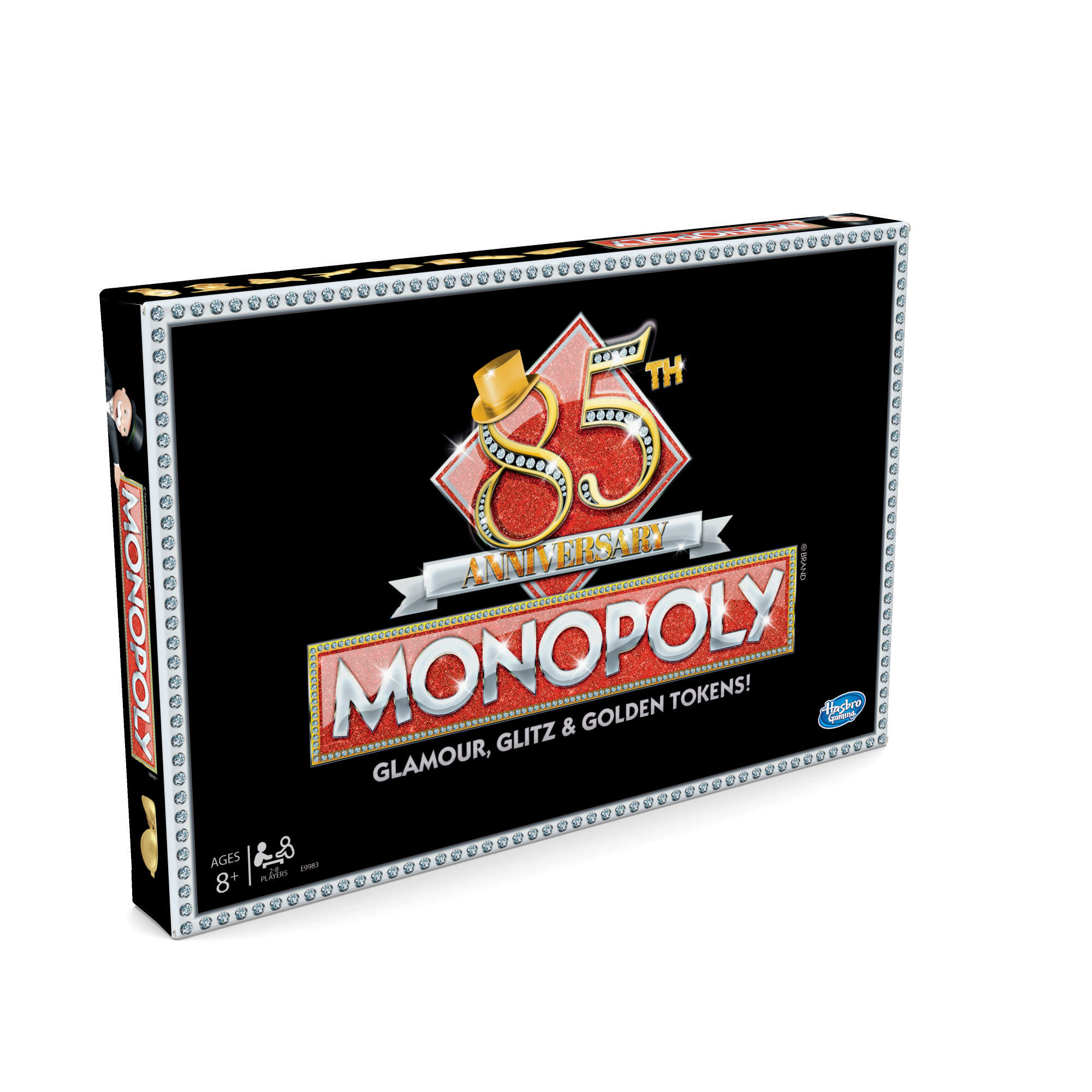

Mozzarella Dippers or Mozzarella Dippers Cheese Shareboxįruit Bag (only if ordered as part of a meal) Here’s a list of which McDonalds food items come with Monopoly stickers: Food Item Note that not all items on the main menu have McDonalds Monopoly stickers and you won’t find them on favourite burgers like the Big Mac, Quarter Pounder with Cheese or Vegetable Deluxe.

0 kommentar(er)

0 kommentar(er)